2020 Recovery Rebates

The CARES Act will be providing stimulus checks up to $1,200 per adult and $500 for a qualifying child. The rebates are subject to phase out limits if your adjusted gross income (AGI) exceeds $75,000 for single taxpayers, $115,000 for joint filers, and $112,500 for head of household. The rebate is completely phased out for single filers, head of household, and joint returns when the AGI exceeds $99,000, $136,500 and $198,000, respectively. The amount of the rebate check that will be provided is based on the 2019 return or the 2018 return, if the 2019 one has not yet been filed. If a 2018 or a 2019 return has not been filed, the individual(s) will not be eligible for the rebate. Once those returns have been filed, the individual(s) will be eligible for the rebate payment.

The rebate checks are expected to be disbursed in April 2020 through direct deposits and physical checks. If you have received your 2019 or 2018 tax return via EFT payment, the IRS will be sending the rebate check through the deposit detail on your most recent return. The IRS is currently in the process of building out a website for taxpayers to update or add their direct deposit information. We will provide a link once the website is up and running. If the IRS does not have your banking information, the rebate will be in the form of a physical check and will be mailed out. This process may add a significant amount of time for those rebate checks to be received.

Retirement Plan Loans and Distributions

Previously participant loans were subject to the lesser of 50% of the participants balance or $50,000. The CARES act permits plan administrators to amend the plan to allow loans lesser than 100% of the qualified individual’s account balance or $100,000. As of April 5, 2020, loans up to the new amounts mentioned above must be taken on or before September 23, 2020.

Additionally, if the plan is amended, loan repayments can be deferred for up to one year for qualified individuals. It is important to note that if payments are not being made on the loan it will continue to accrue interest at the rate of the loan as defined by the plan.

Early distributions taken prior to the CARES act were assessed a 10% tax penalty on funds withdrawn from the plan if the participant was younger than 59 ½ years old. The additional 10% penalty has been waived. Further, the CARES act allows the qualified individual to pro-rate the distribution and include it in their taxable income for the next three years and provides the option to the qualified individual the option of repaying the distribution over a three-year period. The distribution is up to $100,000 across all plans of the qualified individual.

Qualified individuals are defined as a person who was diagnosed with COVID-19, has a spouse or dependent diagnosed with COVID-19 or experiences adverse financial consequences as a result from quarantining, being furloughed, laid off or having hours reduced.

Charitable Contributions

Under the Tax Cuts and Jobs Act taxpayers who selected the standard deduction were not eligible to take a deduction for charitable contributions. Under the CARES Act taxpayers can take a charitable contribution deduction up to $300 against their AGI in 2020.

For those taxpayers that itemize, the CARES Act increases the amount of the charitable contribution deduction from 60% of their AGI to 100% of their AGI. Any contributions in excess of 100% of their AGI is carried forward for the next for the next five years.

Corporations also received an increase in their charitable contribution deduction. The limit increased from 10% to 25% of taxable income. Additionally, the CARES Act increases the limitation for contributions of food inventory from 15% to 25%. Any contributions in excess can be carried forward.

This is big for non-profits and important for them to communicate these changes to donors and potential donors for them to consider in the donor’s charitable contribution plan.

Economic Injury Disaster Loans (EIDL) and Paycheck Protection Program (PPP)

Included in the CARES Act are two loan programs offered to businesses. The first one that we will go over is the PPP.

From February 15, 2020 to June 30, 2020 (covered period), the law allows the Small Business Administration (SBA) to provide 100% federally-backed loans up to a maximum amount to eligible businesses to help pay operational costs like payroll, rent, health benefits, insurance premiums, utilities, etc. Subject to certain conditions, loan amounts are forgivable. The loans do not require a personal guarantee or include any collateral like the EIDLs. The interest rate is set at 1%. If a business entered into a loan on or before 1/31/2020 may be refinanced as part of a covered loan under the program. The funding is prioritized to small businesses, entities in underserved and rural markets, small businesses owned by socially and economically disadvantaged individuals, women owned companies and businesses in operations for less than two years.

The loan amounts are the calculated as the lesser of (A) 2.5 times average monthly payroll costs incurred in the one-year period before the loan is made, (B) 2.5 times the average total payroll payments from 1/1/2020 to 2/29/2020 or (C) $10,000,000. This excludes any compensation for employees earning over $100,000 and foreign employees. For example, if an employee earned $120,000 in 2019 the eligible wages that can be included in the calculation are limited to $100,000. The amounts that businesses should be using to calculate the amount of the PPP Loan they are eligible for is the gross wages reported in their quarterly 941’s.

These loans can be utilized to cover compensation, paid leave, severance payments, health insurance premiums, retirement benefits, state and local payroll taxes, group health care benefits, rent/lease payments, utilities, mortgage interest and interest on any other debt obligations incurred before the covered period.

These loans may be forgiven and excluded from gross income in an amount equal to the costs incurred and payments made during the covered period for payroll, interest payments, rent and utilities. For the loans to be forgiven 75% of the forgiven amount must be for payroll related expenses. The amount subject to forgiveness will be reduced for any employee cuts or reductions in wages. To apply for the forgiveness the borrower must submit to the lender documentation verifying full time equivalent employees and their pay rates, documentation on covered costs, certification from a business representative that the documentation is true and correct and that forgiveness amounts requested were used to retain employees.

Lastly, the PPP loans do not require payments for the first six months. Any amounts that are not forgiven then become due and payable beginning in the seventh month until maturity on the 24th month.

Economic Injury Disaster Loans (EIDL)

Unlike the PPP discussed above, the EIDL provides for an initial payment of $10,000 following the submission of the application. The $10,000 is forgiven and is excluded from taxable income. The EIDL amount is calculated based on the business’s application and can be up to $2,000,000. The interest rate on the loan is 3.75% on for-profit loans and 2.75% on private non-profit loans and can be repaid over the course of 30 years. Payments are deferred for the first 12 months of the loan.

These loans can be used for fixed debts, payroll and related benefits, accounts payable and other expenses that cannot be paid because of the disaster’s impact. They cannot be used for the refinancing of debt, payment of other SBA loans, tax penalties, civil fines, repairs of property or other physical damage or pay dividends or distributions to owners or partners.

| |

Economic Injury Disaster Loans |

Paycheck Protection Program |

| Eligibility |

- Small businesses in the United States and territories, including sole proprietors, independent contractors and eligible self-employed individuals

|

- Small businesses in the United States and territories, including sole proprietors, independent contractors and eligible self-employed individuals

|

- Internationally owned organizations located in the United States.

|

- Internationally owned organizations located in the United States.

|

- Private nonprofit organizations

|

- 501(c) (3) nonprofit organizations

|

- Small agricultural cooperatives

|

- 501(c) (19) veteran organizations

|

|

|

- Tribal small business concerns

|

|

|

- Fewer than 500 employees in most cases, more if certain criteria are met.

|

—-

Written April 6, 2020 by Frank Speicher, YNPN Pittsburgh Board Member

Maria is a Community Engagement Coordinator at Greater Pittsburgh Community Food Bank, where she helps engage a team of more than 6,000 volunteers per year to support various Food Bank programs. She also recently launched her own Consulting LLC to help assist nonprofit and government organizations with closing hiring gaps and maintaining a competitive place in the sector. As if that weren’t enough, Maria just completed her PhD in Community Engagement in summer of 2020! Click

Maria is a Community Engagement Coordinator at Greater Pittsburgh Community Food Bank, where she helps engage a team of more than 6,000 volunteers per year to support various Food Bank programs. She also recently launched her own Consulting LLC to help assist nonprofit and government organizations with closing hiring gaps and maintaining a competitive place in the sector. As if that weren’t enough, Maria just completed her PhD in Community Engagement in summer of 2020! Click  Meet Chloe Brown, Former YNPN Pittsburgh Board Member & Greenhouse Gas Programs Analyst at Oregon Department of Environmental Quality

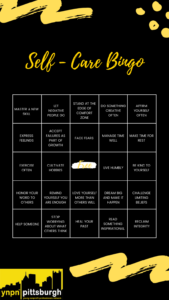

Meet Chloe Brown, Former YNPN Pittsburgh Board Member & Greenhouse Gas Programs Analyst at Oregon Department of Environmental Quality YNPN Pgh wants to remind you to practice good self-care in these trying times. Mix up your routine and try YNPN’s Self-Care Bingo this month. Scratch off a square for each activity you complete and be sure to give yourself a huge pat on the back when you achieve BINGO!

YNPN Pgh wants to remind you to practice good self-care in these trying times. Mix up your routine and try YNPN’s Self-Care Bingo this month. Scratch off a square for each activity you complete and be sure to give yourself a huge pat on the back when you achieve BINGO! During her day job, YNPN Pittsburgh’s Board President Colleen Cadman serves as the Community Engagement Manager at Jefferson Regional Foundation where she facilitates networking, capacity building, and collective action for 99 community-serving organizations who work in the South Hills and Mon Valley communities of Pittsburgh. Colleen is a native Pittsburgher with a passion for community and relationship building – Colleen has been a member of YNPN Pittsburgh for 7 years and holds a master’s degree in Public Management from Carnegie Mellon’s Heinz College of Public Policy. Click

During her day job, YNPN Pittsburgh’s Board President Colleen Cadman serves as the Community Engagement Manager at Jefferson Regional Foundation where she facilitates networking, capacity building, and collective action for 99 community-serving organizations who work in the South Hills and Mon Valley communities of Pittsburgh. Colleen is a native Pittsburgher with a passion for community and relationship building – Colleen has been a member of YNPN Pittsburgh for 7 years and holds a master’s degree in Public Management from Carnegie Mellon’s Heinz College of Public Policy. Click